Considerations for planning learning programmes

Learning programmes need to be relevant and engaging for the learners.

Relevant, engaging programmes are more likely when the various communities that the students identify with are consulted: in particular, the community of learners that make up the accounting class, the wider school community, and the community a student lives in.

Who are the learners?

It is important to consider both the students who chose to learn accounting and those who do not.

In a 2004 survey

*, 79 percent of young New Zealanders (those aged 15–21) claimed that they would like to start up or own their own business (compared to 38 percent in the general population).

This attitude was spread across all demographic groups. A key exception was among Māori young people, who expressed an even greater degree of interest (92 percent) than other groups.

Currently, students keen to be involved in a business are not represented in senior accounting in the numbers suggested by the 2004 BRC Marketing and Social Research survey.

Effective teaching programmes are based on the learning needs of the students, building on their prior knowledge and interests and reflecting what is important to them. Planning for effective teaching and learning involves:

- identifying important learning

- being clear about which concepts students need to develop

- designing a flexible sequence of learning activities that will support the students to achieve desired learning objectives.

Planning involves finding out about the students in front of you. Two exploratory activities include:

- A post-box activity: Provide question slips that will yield insights into students’ lives and dreams, for example: What are you passionate about? How do you spend your leisure time? What would you do with $100? What would your ideal job be? Who do you admire the most and why? Have students sort the anonymous answers and group the information on the whiteboard as a discussion starter.

- Ask students to find out something surprising about one of their classmates and include this information as they introduce them to the class.

* BRC Marketing and Social Research. (2004). Developing a culture of entrepreneurship among young people in New Zealand. Stage Two: Quantitative Benchmark Survey. New Zealand Trade and Enterprise, July.

TOP

Why choose particular content and contexts?

Effective programme planning identifies the content and timing of important learning, so that it takes account of the needs and interests of the students. This is the difference between coverage of the curriculum and meaningful learning when introducing and building the big ideas in accounting.

Build on prior knowledge

Refer students to recent or current experiences (for example, part-time jobs or involvement in clubs or church groups) when considering accounting concepts such as confidentiality, reliability, and citizenship.

From their other experiences, students will be able to understand an employer’s expectation that they can be trusted to carry out their role in an efficient and timely fashion without being supervised (reliability).

Use examples from family settings, for example, saving for holidays or luxury items, budgeting for weekly food, or doing volunteer work for the local school, to explore concepts of accountability, citizenship, and sustainability.

Field trips

Effective programme planning incorporates excursions and/or field trips, (or could link with field trips in other subject areas) to explore, for example, ideas of sustainability and accountability.

The accounting class could offer to investigate financial options for a health and physical education trip to the Marlborough Sounds and consider how records could be kept from various fundraising activities.

Cater to students’ diverse needs

- Use exit cards with a question or instruction that requires a brief response after a lesson, for example:

- Write down one thing you learned today.

- Write down one question you have about today’s lesson.

- Write down one thing that would have helped your learning.

- Write down one thing you need to follow up on.

The students hand in their unsigned responses as they leave the classroom.

The teacher reviews the feedback and uses it to guide planning for the next lesson.

- Design varied activities that ensure students have multiple opportunities to use different key skills to make sense of essential ideas and information.

- Provide different tasks of varying levels of complexity (for example, completing an income statement with varying levels of information supplied).

- Offer differentiated levels of support, for example, learning independently by working through a worksheet or working in a small group with the teacher on the same material.

- Offer students different choices for demonstrating their learning, for example, they could describe the steps required to complete a cash statement by: using a flow chart, giving a verbal presentation, or teaching a classmate how to do it.

- Draw a picture of an accountant or name a famous accountant and ask the class describe what a typical accountant does …

- Create a 'bank' of financial myths.

Include opportunities to confront misconceptions

Test students with a quiz about them.

Add to the bank throughout the year from students’ found examples, encouraging them to reveal their own misconceptions as they are become aware of these.

Identify contexts familiar to students and relevant to the community

- When thinking about possible contexts, suggest that students choose a community organisation within a 2 km radius of the school or choose to focus their learning on a business that they have used in the past month, for example, a pizza outlet, or the local pharmacy.

- Use popular music to introduce ideas, for example, Simply Red’s “Money’s too Tight to Mention”, Pink Floyd’s “Money”, or Travie McCoy’s “Billionaire”.

- Analyse movies to introduce topics, for example, Catch Me If You Can (integrity, citizenship).

Respond to different learning styles

Select activities that engage the different thinking and learning styles of students and use a variety of learning materials to build understanding of the big ideas in accounting:

- Activities could include some that involve problem solving, making choices, and open-ended investigations and others that are highly structured, including step-by-step instruction, and with limited outcomes.

- Provide opportunities for group and individual work, and incorporate choices about collaborating with others.

- Use

puzzle-maker.com to create a crossword to help reinforce accounting concepts.

Check on how things are going

Build in opportunities for students and teachers to check student understanding and progress:

- Flying in 5: Use five-minute introduction activities at the beginning of a lesson to check understandings.

- Use reflection tables for students to self assess against achievement criteria or a checklist of skills and knowledge.

- Schedule opportunities for feedback on draft material before final deadlines.

Being flexible and adapting learning programmes

Adapt teaching intentions, depending on student progress and understanding. Use information gathered from different feedback processes or end-of-unit assessments to adjust the programme to meet students’ needs.

Apply the

teaching as inquiry process to assess the effectiveness of your teaching strategies and identify next steps for learning.

TOP

Structural and timing considerations

Schools and teachers will make their own decisions about planning and designing learning programmes to meet the diverse needs of their students.

Teachers need to plan balanced programmes at each level, flexible enough to develop and challenge students continuing to the next level and to support students beginning that year, or studying only at that level.

- Consider the

big ideas in accounting and accounting practices.

- Consider progression in accounting, outlined in the subsection (below) Framework for progression in accounting: contexts for learning (you can also click on the attached PDF of the same title for a diagrammatic version).

- Make links to the values, principles, and key competencies of The New Zealand Curriculum.

- Consider your

pedagogical approach.

- Consider

assessment.

TOP

Requirements

The pedagogy section of this guide describes key pedagogical requirements of effective teaching programmes. In summary, an effective senior accounting programme:

- meets the needs of all students

- is relevant to the students, their whānau, and communities

- generates interest in and the capability for managing finances

- supports students to be responsible for their learning, reflect on their progress, and take action to maximise their learning

- creates multiple opportunities for students to learn in ways that meet different learning and thinking styles

- provides extensive scaffolding (described as the teacher’s purposeful use of guidance, modelling, and support while handing over responsibility, increasingly, to the learner)

- uses new technologies to maximize learning

- prepares students to live in the twenty-first century.

- Learning outcomes are based on the

accounting learning objectives and indicators.

- Next steps for learning are based on students’ current understandings.

- Appropriate challenges (high but realistic expectations) are provided.

Other considerations

NCEA

Learn more:

TOP

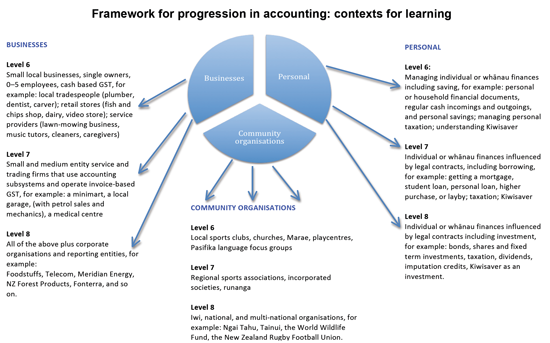

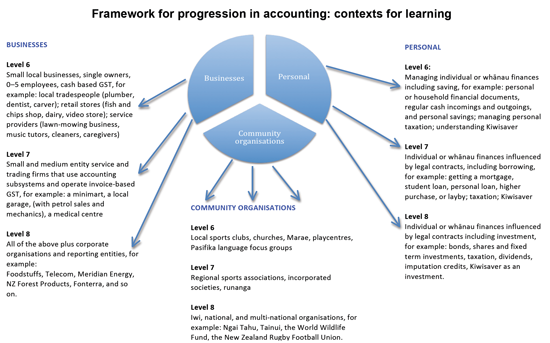

Framework for progression in accounting: Contexts for learning

In the diagram of the framework for progression in accounting (see the attached PDF below), the three context areas of business, community organisations, and personal are represented as equal segments of a single circle, an image which expesses their interrelatedness.

Business

Level 6

Small local businesses, single owners, 0–5 employees, cash based GST, for example: local tradespeople (plumber, dentist, carver); retail stores (fish and chips shop, dairy, video store); service providers (lawn-mowing business, music tutors, cleaners, caregivers).

Level 7

Small and medium entity service and trading firms that use accounting subsystems and operate invoice-based GST, for example: a minimart, a local garage, (with petrol sales and mechanics), a medical centre.

Level 8

All of the above plus corporate organisations and reporting entities, for example:

Foodstuffs, Telecom, Meridian Energy, NZ Forest Products, Fonterra, and so on.

Community organisations

Level 6

Local sports clubs, churches, Marae, playcentres, Pasifika language focus groups.

Level 7

Regional sports associations, incorporated societies, runanga.

Level 8

Iwi, national, and multi-national organisations, for example: Ngāi Tahu, Tainui, the World Wildlife Fund, the New Zealand Rugby Football Union.

Personal

Level 6

Managing individual or whānau finances including saving, for example: personal or household financial documents, regular cash in-comings and outgoings, and personal savings; managing personal taxation; understanding Kiwisaver.

Level 7

Individual or whānau finances influenced by legal contracts, including borrowing, for example: getting a mortgage, student loan, personal loan, higher purchase, or layby; taxation; Kiwisaver.

Level 8

Individual or whānau finances influenced by legal contracts including investment, for example: bonds, shares and fixed term investments, taxation, dividends, imputation credits, Kiwisaver as an investment.

Resources

The following three resources are provided as aids for programme planning.

Framework for progression in accounting: Contexts for learning

A checklist for programme planning.

Framework for progression in accounting

Accounting checklists: Programme planning

Accounting checklists (various)

Last updated October 11, 2021

TOP